Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a research scientist who makes $99,000 per year and spends some of her money this week on Persepolis by Marjane Satrapi.

Occupation: Research Scientist

Industry: Biotech

Age: 30

Location: Bay Area, CA

Salary: $99,000

Net Worth: ~$85,000 ($45,000 savings + $30,000 Roth IRA + $19,000 Roth 401k + $4,000 brokerage account – debt) I don’t know the value of my car so that’s not included. I also have stock options but none have vested.

Debt: ~$13,000 (car loan)

Paycheck Amount (2x/month): $2,068.33 (after taxes, health insurance, and retirement contributions are taken out)

Pronouns: She/her

Monthly Expenses

Rent: $0 (I live at home and my parents don’t charge rent)

Car Loan: $313

Car Insurance: I was added to my family’s plan and they haven’t cashed the check I wrote for it

Utilities/Internet: $0 (see rent)

Cell Phone: $0 (I’m on my family’s plan and my parents pay)

Health Insurance: $75

Train Pass: $185 (reimbursed by my employer)

Netflix: $14

Spotify Premium + Hulu: $10

Donations: $50-$100 to various organizations

Retirement: $1,568 (19% contribution to my Roth 401k) + $500 to my Roth IRA (I usually deposit the maximum as a lump sum but this is the amount by month)

Savings: I aim for at least $2,000-$3,000 a month, which is the amount I would otherwise be spending on rent.

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Absolutely. I’m second generation, grew up in an academically driven city, and both of my parents have master’s degrees. There was no alternative to going to a “good” college and getting a “good” job. My parents had an education fund that covered all of my undergrad expenses (I chose a public school over a private one to avoid loans). I’ll be forever grateful that I have no student debt. When I was a STEM Ph.D. graduate student, I received a stipend (~$30,000/year on average over five years).

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

The conversations were basically, “Don’t spend money.” My mom helped me open a savings/checking account and credit card when I started college. The only thing I can remember my parents teaching me about is how to write a check. They’ve set me up for success, but it’s my responsibility to learn things for myself. Friends and the internet have helped, and I’m also thinking of talking to a financial advisor for help, especially when it comes to investing and my stock options.

What was your first job and why did you get it?

I was told to focus on school and not worry about getting a job. In high school, I interned at the company where my mom worked. In college, I was a course grader and while grad school is essentially a job, technically, my current job is my first job.

Did you worry about money growing up?

Yes and no. My parents have always been frugal, verging on cheap; they’re a bit more comfortable spending money on food now but that’s it. Money was tight when I was younger, but we were definitely financially stable and well-off by the time I was in high school. However, my parents had gotten financial help from their parents and anytime money was discussed, a huge fight would follow. These experiences have really impacted the way I view money and how it affects people and relationships. In general, I’m terrified of being in debt (getting a car loan was a mental hurdle I had to get over).

Do you worry about money now?

Yes. I graduated in the middle of the pandemic and just started my first adult job at 29. In grad school, I was living paycheck to paycheck but I was able to save a little because I already come from a place of financial privilege. Most of my current savings are from this past year alone. I’m extremely grateful I’m able to live with my parents rent-free; however, compared to my friends who got jobs out of college, I feel really behind in terms of general and retirement savings, housing/property, career, etc. I didn’t think about any of that when I decided to enter a five-year Ph.D. program in my early 20s. I’m also an only child and will have to care for my parents when they’re no longer able to themselves since we don’t have family in the U.S. My parents have retirement savings, but I am their retirement/caretaker fallback plan.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I became financially responsible for myself at 23 when I started graduate school. My parents are my financial safety net. I could afford to rent a place right now, but I want to eventually buy something if it’s possible, and paying rent would extend an already long timeline.

Do you or have you ever received passive or inherited income? If yes, please explain.

My parents paid for undergrad. For my birthday and Lunar New Year, I got about $20-$50 as a kid and $50-$200 as an adult. I went to grad school across the country so whenever I flew home to visit or went on trips, my parents would deposit money in my account to cover the cost of my flights even when I told them I didn’t need it. Right now, I don’t have to pay rent, utilities, etc. My dad also helped put a significant downpayment on my car (it’s my first one) as a graduation gift, and I assume I will inherit most of their estate when they die.

Contents

Day One

6:30 a.m. — Today’s the last day of a (virtual) biology conference. There’s a keynote talk I want to attend but it’s at 7 a. This may interest you : Roth IRAs – The Swiss Army Knife in Your Financial Belt.m. Typical of me, I stayed up late last night to finish Because This is My First Life, a Korean drama on Netflix that was surprisingly great, so I snooze my alarm repeatedly and reconsider my life choices.

7 a.m. — I’m unable to get out of bed so I just sign into the conference talk on my phone, prop it up on my nightstand, and watch it while lying on my stomach. I fall back asleep about 15 minutes before the talk ends.

9 a.m. — I’m up! My job as a research scientist is to confirm through experiments whether a gene we think is involved in a disease actually plays a role because a statistical hunch is very different from what actually happens in a biological setting. If the gene is involved, the goal would be to develop a drug that targets it in a way that improves disease. I’m in between a few projects, so I’ve been working from home for the last two weeks. Since starting my job, I’ve been going on-site/into the lab pretty much every day to run experiments, so I’ve been using this much-needed time to catch up on admin and computer stuff. I make myself a cup of jasmine tea and eat a bun from a Chinese bakery for breakfast.

12 p.m. — I heat up some leftovers from last night’s dinner for lunch. Since I moved home, we have been getting takeout very, very often. None of us like cooking, and we don’t like each other’s cooking. We rarely ate out when I was growing up but in their older age, I think my parents are trying to enjoy life a little more and they have the financial means to support this takeout habit.

1 p.m. — I love conferences — there’s nothing quite like a bunch of people passionate about the same things as you, all congregating into one space. I log onto the conference website and watch a few more relevant talks. Due to the pandemic, my company allows employees to take Friday afternoons off. I haven’t really been able to do that, but today I end my work week around 3 and immediately feel guilty. I know I shouldn’t be, but grad school hardwired me to run myself into the ground, and I haven’t shaken off that mentality.

6 p.m. — For dinner, we decide on Chipotle, the only non-East Asian cuisine both of my parents will eat. I place an order online for pick-up. I pay for it because my parents literally pay for everything else and have difficulty navigating apps and online order forms. $20

9 p.m. — While doing a load of laundry, I finish reading One Last Stop by Casey McQuiston. I don’t like it as much as McQuiston’s first book, Red, White & Royal Blue, but it’s still a really fun read. I’m mostly an e-book and audiobook reader thanks to Libby, but Libby’s only great if you have access to a large and well-funded city library system.

11 p.m. — I get ready for bed since I’m heading into San Francisco tomorrow to meet my friend. (FYI: At the time of writing this, CA is about to fully open up, and I am and everyone I meet up with is fully vaccinated. I also continue to wear a mask in public spaces.) My parents didn’t teach me finances, but my mom taught me skincare. I try to only buy products when there’s a discount code. Pre-pandemic, my mom went to Asia often and would buy certain brands there because it’s cheaper. I take off my makeup with micellar water on a reusable makeup pad or with an oil cleanser and then double cleanse with a gentle facial cleanser. Nighttime skincare consists of an essence, serum(s), moisturizer, and facial oil. My eczema came back a few years ago and the flare-ups haven’t stopped, so I apply some steroid cream to the patches and moisturize my body. I’m in bed by 12.

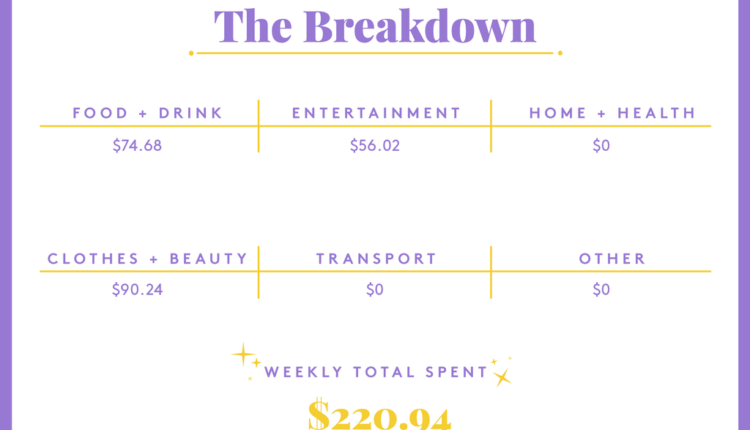

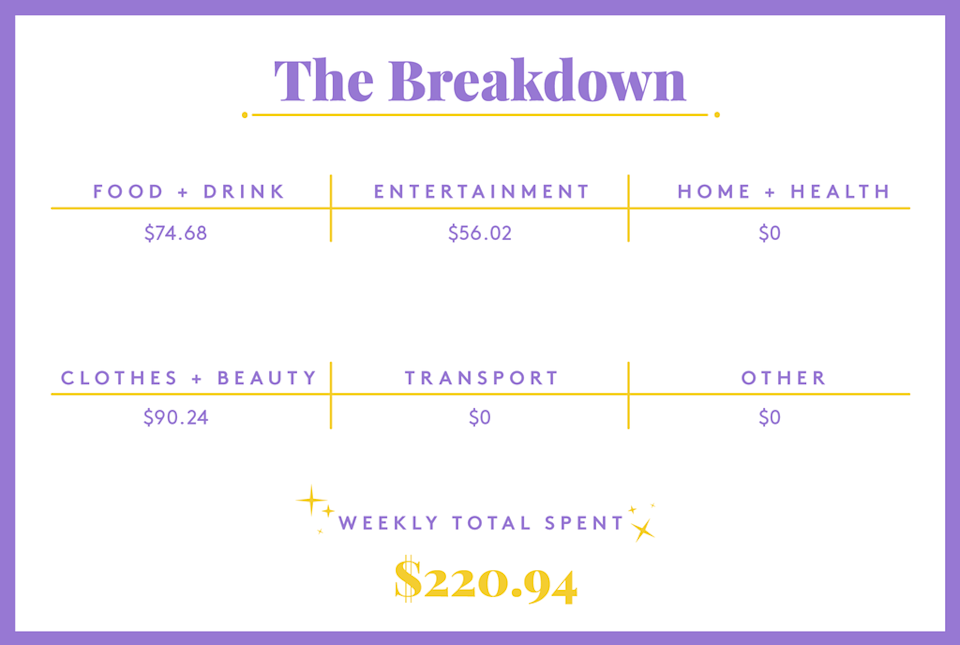

Daily Total: $20

Day Two

8 a.m. — I’m a zombie, but I’m an on-time zombie. I get something in my stomach (strawberry Pocky) plus jasmine tea. Through work, I have a monthly pass that I can use any day of the week, so I take the train to SF today. See the article : Opinion: COVID-19 has prompted a boom in retirement savings. I also place a pastry order for pickup from a bakery. As someone who has “outdoor” and “indoor” clothes, I’m happy for the chance to wear some of “outdoor” clothes after two weeks in sweatpants. Today’s outfit is: an old jacket à la Lindsay Weir, a Tuesday of California ringer tee, Elizabeth Suzann pants (sample sale), Vans, and a Big Bud Press tote. $17.27

10:30 a.m. — I arrive at my train stop and as I look around for a quiet street to wait, I see my friend, T., pull into the pick-up zone close to where I’m standing. We’re two pessimists and were met with a lot of bad luck last time we met up, but today, the glass might just be half full. The bakery is nearby so we make it there in no time. We eat the pastries at her apartment. This might be the best ham and cheese croissant I’ve ever had.

12 p.m. — After eating, we walk to the de Young Museum for our ticketed time slot. As a membership holder, T. gets to bring a guest (me!) along for free. The Bouquet to Arts exhibit happens once a year where local florists and flower artists design floral “arrangements” inspired by a specific painting or item and they’re displayed side by side. I would describe it as 3D impressionist interpretations of (mostly) 2D art. It’s incredibly cool and creative.

1:30 p.m. — We finish going through the museum and stop by the gift shop. I pick up the book Flower Color Theory by Darroch and Michael Putnam for my mom as she is always looking for inspiration for the floral arrangements she does for her church. T. pays since she gets a discount with her membership, and I pay her back. $31.50

2 p.m. — At the museum cafe, we split a salad and a bag of chips, and we each get a drink. I don’t drink a lot of carbonated drinks and discover that San Pellegrino (the blood orange flavor) is delicious. We take a long walk through Golden Gate Park back to her apartment before I head home. $15.44

6 p.m. — For dinner, my parents and I decide to order from a local Muslim Chinese food restaurant that we’ve eaten at for as long as I can remember. The knife-cut noodles are a must-order item for me. I eat a peach for dessert.

10:30 p.m. — After dinner, I surf the internet but am pooped. I was sweating a bit in my face mask earlier when I was walking around so I do a clay mask. Then I get ready for bed early since my friend, A., and I want to go to a grand opening for a pearl milk tea place in the morning.

Daily Total: $64.21

Day Three

7:30 a.m. — I wake up to texts from A. saying the store actually opens at 11 and not 8 like we thought, so we can leave a little later. I semi-nap before getting up and ready. Read also : Should I Get a Financial Advisor?. I go through my morning skincare routine of essence, moisturizer, and sunscreen. I have redness and hyperpigmentation from years of hormonal cystic acne (it’s better now thanks to medication) so I like to even things out with some makeup. I also put sunscreen on my hands and ankles because they see a lot of sun.

9:30 a.m. — We head out. Today’s outfit is a Madewell cropped tee, Elizabeth Suzann linen culottes, Birkenstocks (suede upper + soft footbed is key), and a Baggu crossbody bag.

10 a.m. — At the store, there’s a long line down and around the block so we decide to bail. The store is a chain and we find another location that’s open just 10 minutes away. I get a jasmine milk tea (half sugar) with pearls. The tea flavor is great but for me, the real test of every milk tea place is the texture of the pearls, and these are perfect. $4.91

11 a.m. — We head to a downtown area where there’s a Recycle Bookstore. I’ve never been before and find used copies of two graphic novels that I wanted to read: Good Talk by Mira Jacob and Persepolis by Marjane Satrapi. I don’t resist. $24.52

12:30 p.m. — I’m home and eat leftover noodles for lunch. Like a lot of people, I started reading again during the pandemic but because I read pretty fast, my head started feeling very full. My solution? I started a book-related Instagram, or a bookstagram as the young people would say, and it’s helped. I post a quick review of One Last Stop.

4:30 p.m. — My dad wakes up from a nap and declares he wants to go to Costco. I tag along to make sure we stock up on peaches, and we also get some non-perishable snacks for a road trip we’re taking soon. We hit a bit of a snafu when he realizes he never took the receipt from the self-checkout kiosk, and I realize I accidentally ordered two hotdogs and one pizza instead of two pizzas and one hotdog. Two years ago, this would’ve sent me into a panicked rage but I’m in a much better mental place these days. The Costco manager prints out a copy of our receipt and I eat a hot dog instead of pizza for dinner; all is fine.

8 p.m. — I get a little hungry and snack on a peach. When I go to compost the core, I realize my reusable water bottle has been sitting in my backpack, untouched, for two weeks. I try not to think about all the little microscopic communities inside as I give it a good clean.

12:15 a.m. — This is the first time I’ve lived in CA in several years and while I am excited to be able to see childhood and college friends again, I’m also extremely introverted and have gotten used to (and loved) the lack of social interaction during the pandemic. This weekend has left me exhausted. I shower and get into bed. It’s hot and stuffy tonight so I toss and turn for at least an hour before falling asleep.

Daily Total: $29.43

Day Four

7:30 a.m. — I sometimes have really vivid dreams and am pulled out of one by my alarm. The really creative ones (like out of a fantasy or sci-fi world) get a dream journal entry — this one was more like a frantic scrambled mess so it doesn’t get one. I eat a bun and have some tea. I’m going in to work today so I fill out the daily COVID-related questionnaire on-site employees have to do on my phone.

8:20 a.m. — The train is late which always makes me nervous because I have a three-part commute with little buffer room. I’m trying to be better at letting go when things are out of my control, but public transportation is my weak spot.

9:30 a.m. — I make it to my stop right on time to catch the bus to work. They redid the open office setup over the weekend and my section doesn’t have electricity yet, so I grab iced tea from a break room and find a small room where I can do some computer work. We can take off our masks when we’re in a closed room by ourselves but otherwise, it’s on all day. I spend the morning trying to figure out how to access a database with our IT department’s help.

11:30 a.m. — Success! We find out I can get around the random glitch if I use incognito mode. Right in time for lunch. Lunch is provided for on-site employees which is a huge time and cost-saver. I get salad, farro, chicken, and a cauliflower steak. The roast chicken tastes exactly like McDonald’s chicken nuggets which confuses and amuses me.

1 p.m. — For the rest of the day, I work on experiment plans for a project that I’m going to start helping with. Part of what I enjoy about research is that you never stop learning. At 4, I head out. On the train, I listen to Say Nothing by Patrick Radden Keefe on audiobook. I don’t know much about The Troubles, but it’s horribly fascinating so far.

5:30 p.m. — When I get home, I immediately head to the kitchen. My mom reminds me that today is a holiday so I heat up a savory zongzi, which is what’s traditionally eaten for this festival. She also starts talking about things I’ve told her aren’t up for discussion, so I grey rock her and eat in my room. I also eat strawberries (with some granulated sugar) and a peach.

6:30 p.m. — My ankles are still a little sore from the walk I did in SF, and I realize I don’t have any suitable footwear for our road trip which will involve walking. A friend points me towards Chacos and I decide on a pair that is on sale. I sign up for the newsletter to get an additional 10% off and use the Rakuten to get 4% cashback. I assume browsers are already tracking my every internet move so I might as well get some money back. $90.24

10 p.m. — I roll out my yoga mat to do some stretches. I try a few new wrist strengthening exercises and later realize I must’ve pinched a nerve because afterward most of my right hand goes numb — I think this is also a symptom of carpal tunnel syndrome. D’oh!

11:30 p.m. — I’m in bed and try to keep my arm straight as I fall asleep (I pinched a nerve last year and know to give it a few days). As I fall asleep, feeling slowly returns to my hand. Thank goodness.

Daily Total: $90.24

Day Five

6:30 a.m. — I snooze until the last possible minute. Project members are scattered on the East Coast and in Europe so those on the West Coast have early meetings. I have a 7 a.m. one today but at least I get to work from home. Breakfast is a bun, a plum, and black tea. A slight tingling sensation comes back when I use my right hand too much so I rest my straightened forearm on my desk on-and-off throughout the day.

11:30 a.m. — My dad orders lunch from a local Chinese food place and I go with him so I can get whole-wheat toast and tea. I get my usual passion fruit green tea with coconut jelly and pearls (half sugar, less ice) and also order for my parents. We complete a stamp card today so one drink is free. I pay for the bread and tea. $17.06

5:30 p.m. — For the rest of the day, I have meetings and continue inputting all the experiments I’ve done into our electronic lab notebook system. I’m on around day 12 of this task, and I make a mental note never to put this off again. Dinner is leftovers.

7:30 p.m. — It’s my second ever therapy session. It’s virtual and my parents don’t “believe” in therapy, and I’m also worried that they’ll overhear, but I’m glad I’m doing it. I’ve been putting it off for years partly because I don’t want confirmation that I’m not, in fact, totally fine, but my work benefits cover a few sessions so I figured it’s now or never. My session goes well but afterward, I need something entertaining and familiar, so I watch a few episodes of No Reservations.

11 p.m. — I find myself on YouTube and nearly cry watching baby seals learning to swim, and then it’s just a downward video spiral from there. I’m in bed at 1 a.m. Oops.

Daily Total: $17.06

Day Six

8:30 a.m. — For breakfast, I make an egg, mayo, and cucumber sandwich with the toast I bought yesterday and a cup of tea. While scrambling the egg, I accidentally spill half of it on the floor so I crack another one. The sandwich actually ends up tastier than usual because of the extra egg.

9:15 a.m. — Today’s WFH schedule is meetings and more experiment inputting. I listen to music because tuning out familiar music helps me focus. Recently, it’s been a lot of Meat Wave and Dark Stares.

10:30 a.m. — I eat some cut-up watermelon with a sprinkle of salt. My dad has been trying to perfect the art of choosing the perfect watermelon and he did well with this recent one.

1 p.m. — My mom picks up Japanese food for lunch on the way home from the dentist. I eat salad, teriyaki salmon with rice, and miso soup. She also got me a jasmine green tea with aloe vera. I’ve had way too much tea this week but I can never say no when it’s in front of me. I’m going to lay off the tea next week, though.

5:45 p.m. — After work, I head out to ceramics class. My wrist still feels a little weird, but I’m mostly trimming pots today which isn’t too straining. I wear a Big Bud Press tee under a Beaton Linen jumpsuit and a Big Bud Press apron. I also wear a really old pair of Vans that I keep around for messy activities. For the last few years, I’ve tried to buy from slow fashion brands or secondhand where I can, and I’ve been buying fewer clothing items overall… but there’s something about Big Bud Press that makes me want to buy every one of their items in every color.

8:30 p.m. — Since it’s near the end of the session, we can only work on pots we’ve already made. I finish up early and head home to eat dinner (leftovers + plum). I started doing ceramics a few years ago around the time I was getting disillusioned with science. I was carrying out a lot of animal studies at the time, and I wanted to create things with my hands instead of just taking away. I found ceramics really grounding both physically and mentally and was glad I could find a new studio.

9:30 p.m. — While cleaning my room, I accidentally break a ceramic catchall tray that I bought on a trip. It’s salvageable, but dang, the week started on such a high and is ending on a weird note.

11 p.m. — My sleeping habits have been really bad this week, so I go to bed on time tonight.

Daily Total: $0

Day Seven

7 a.m. — Get up, breakfast, train.

12 p.m. — It’s food truck day at work which happens once every few months. I’m really lucky that I actually like my coworkers and the company. I also know I’m good at what I do and worked hard to get here, so I try to remind myself that the company is also lucky to have me. I get a chicken burrito, a samosa, and my favorite, gulab jamun. The rest of my day consists of meetings, checking lab supplies, emails, and experiment inputting.

5:30 p.m. — When I get home, I eat my lunch leftovers for dinner and some watermelon. I send a few more work emails before closing my laptop. Tomorrow is a company holiday and a major heatwave is hitting us, so I’m looking forward to staying inside with the fan on and the curtains drawn.

12 a.m. — I spend the rest of the night on YouTube and Hulu (No Reservations again) before calling it a night. I have a “the one that got away” dress I’ve been eyeing for over a year from a made-to-order brand (Thread + Sprout) and it’s coming “back in stock” tomorrow morning so I set an alarm. I was fresh out of grad school the last time it was available and couldn’t afford it… but I can now and am going to try to get one. Fall asleep with excited anticipation.

Daily Total: $0

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Madison, WI, On A $52,800 Salary