“If you have a tax trainee, you don’t have a tax planner.” – James Pollard’s CPA

“Tax preparations are focused on the preparation of this year’s tax return and the tax administration … everything is related to what happened last year. Let’s do it and move on … unlike in tax planning, the approach is future-oriented and says, ‘what can we do proactively to make sure we minimize how much we have to pay the IRS?’ ” “Steven Jarvis, CPA.”

I recently listened to a book by James Pollard Podcast “Advisor Coach” with guest Steven Jarvis, CPA. People who are not from the industry will not recognize those names. Still, I wanted to properly attribute it to the couple who inspired this week’s column. I know other financial advisors read my columns, so I want to help them.

Sometimes when you listen to podcasts, you learn new things (which I did), and sometimes your beliefs are confirmed (which also happened). My supported opinion is that … you’re not as rich as you think you are.

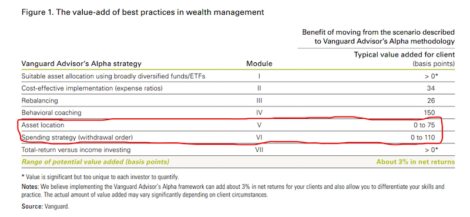

I’m not just talking about the additional growth that your investment portfolio could achieve if you hold certain securities in certain accounts. According to Vanguard Group, depending on the type of your account, by properly allocating assets you could earn an additional 0.75% return per year.

By withdrawing your assets in the correct order (also known as your spending strategy), you could earn an additional 1.10% return per year. PricewaterhouseCoopers i Dawn confirm similar findings – appropriate tax considerations could be worth almost 2% more per year for the growth of your portfolio. (Where you fall into these value ranges depends on things like your ratio of taxable bills to deferred taxes).

Investments with growth potential and low dividend payments should be placed in taxable accounts. In contrast, some bonds and high dividend payers may go to deferred tax accounts. If you use actively managed mutual funds, they should be placed in deferred tax accounts to protect you from allocating funds at the end of the year. And if you’re investing in individual stocks, I hope you’re not paying anyone for it. There are dozens of studies showing how pickers routinely submit their benchmarks. Is it worth paying someone to take a higher risk without giving an extra return? Investing in a tax-efficient way seems like a superior strategy.

But there is more to it than your gain. It’s also about keeping what you have. Suppose you have a $ 2 million investment portfolio, evenly split between a taxable trust account and a deferred tax account (like an IRA or 401,000). When you take money from a taxable account, you have to pay capital gains tax. So you only have about $ 800,000, not a million dollars. And when you take money from deferred tax accounts, you will have to pay ordinary income taxes. Let’s be conservative and say the tax rate is 25%. You only have $ 750,000, not a million dollars.

You don’t have $ 2 million – you have $ 1,550,000 and a deferred tax liability of $ 450,000.

You want to be tax efficient with your investments because you will make more money. And you want to be tax efficient when your money goes out because you will keep more money.

Many people keep money in their IRAs until the early 70s, when they then have to take the necessary minimum distributions (RMDs). If they need money, they take it from a trust account. Assets on the trust account are taxed at the rate of capital gain (up to 20% for wealthier investors). IRA distributions will also be taxed at the usual rate of return, which is often higher for wealthy investors. But it’s not that simple.

When you start withdrawing money from your IRA, it could be large enough that your distributions will be taxed at much higher rates. In addition, these distributions may cause some of your social security payments to be taxed. The solution could be to withdraw relatively small amounts from your IRA earlier so that distributions are taxed at the lowest possible rate. Federal income taxes for 2021 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. The goal is to direct as many distributions as possible through the lowest rates. You don’t want to be in your 70s and jump from 12% to 24%. Or, if you earn more, from 24% to 35%.

You could also talk to your financial advisor about turning your IRA into a Roth IRA. You can withdraw from the Roth IRA tax-free, but there is a cost to claiming that benefit. When you contribute to a Roth IRA, you are not allowed to deduct taxes, as you can do if you contribute to a traditional IRA. When you transfer from an IRA to a Roth IRA, you will need to pay income tax on the amount converted to make up those deductions you previously took. Your advisor may benefit from the conversion if you are in a higher tax category when withdrawing money. Or there may have been a stock market crash, so you can take advantage of temporarily suppressed asset levels. Or you may want to leave your heirs tax-free assets with no income, which could be more like family planning than tax planning.

For those who are philanthropic, you can reduce or fully satisfy your RMD by giving the distribution to a Qualified Charitable Distribution (QCD). Donations for QCDs are counted in RDMs, but are not taxable. (No, you can’t also ask for a QCD as a charitable deduction, but a good try). And, of course, you can collect losses on your taxable accounts to compensate for profits and certain income.

Some investors only look at returns. They don’t look at fees and don’t take into account the hundreds of thousands – or millions – of dollars that could be lost due to taxes. It is not wise to let taxes be the primary driver of your investment strategy. You should start with investments that are good for you and then do tax planning around those securities. Managing the taxes you pay doesn’t have to be complicated, but it needs to be planned.

Taming the rage of anger

Last week, I noticed that, according to Federal Reserve President Jerome Powell, I was wrong to think that the U.S. economy had made enough “significant progress.” The Fed said they must see significant progress before tightening monetary policy by reducing the amount of bonds the Fed buys. (“Narrowing” is the Fed’s preferred nomenclature to reduce bond purchases.)

The Fed is currently buying $ 120 billion worth of bonds, or treasury and mortgage-backed securities (MBS). This process is called quantitative easing or QE. As I pointed out, the end of QE is important for investors because many of us remember the “shrinking” of the 2013 stock market. Taper tantrum is a stock market sale in response to QE mitigation.

As I mentioned in my last column, the three Fed presidents agreed with me that the reduction in bond purchases will come sooner rather than later. Last week, Fed Governor Christopher Waller joined the crowd “before, not later”. Speaking about job growth, Mr Waller said, “it’s significant growth and I think you might be ready to announce [on bond purchase tapering] in September. ”Given that the narrowing announcement (but not necessarily the actual one) is shrinking as early as next month, the stock market historian could now be nervous.

However, I don’t care anymore. I delved into the details of the last Federal Reserve meeting and came to that conclusion. I had the information a few hours before sending last week’s article, but this is a complicated and nerdy thing. I will try to explain it at the level of “you understood”, at the level of 29,000 feet. At 30,000 feet, I see this as insuring the stock market against the wrong step of Fed policy. That means I will keep my shares a little longer.

The Fed has established a new repo option (to put it simply, a “repo option” is a place where investors can buy and finance a purchase). This repo option gives banks a place in the Fed to park their money and earn a higher yield.

Suppose the Fed starts to shrink. They want to avoid tantrum. So, the Fed allows banks to borrow money super cheaply from this new repo facility, and then turn right and buy high-yield treasury bills and MBS. The Fed gives banks a way to make more cash, while maintaining liquidity in the system. The stock market – and bank shares in particular – has become more interesting.

It’s Allen Harris owner of Berkshire Money Management in Dalton, Mass., which manages investments in excess of $ 500 million. Unless explicitly identified as original research or data collection, some or all of the listed data may be attributed to third party sources. Unless otherwise stated, any mention of certain securities or investments is for illustration purposes only. Advisor clients may or may not hold securities referred to in their portfolios. The advisor does not claim that any of the securities discussed were or will be profitable. Full data disclosure. Direct inquiries: aharris@berkshiremm.com.