Comparing Roth IRA and Traditional IRA: Making the Right Choice for Your Retirement

Contents

What is a Roth IRA?

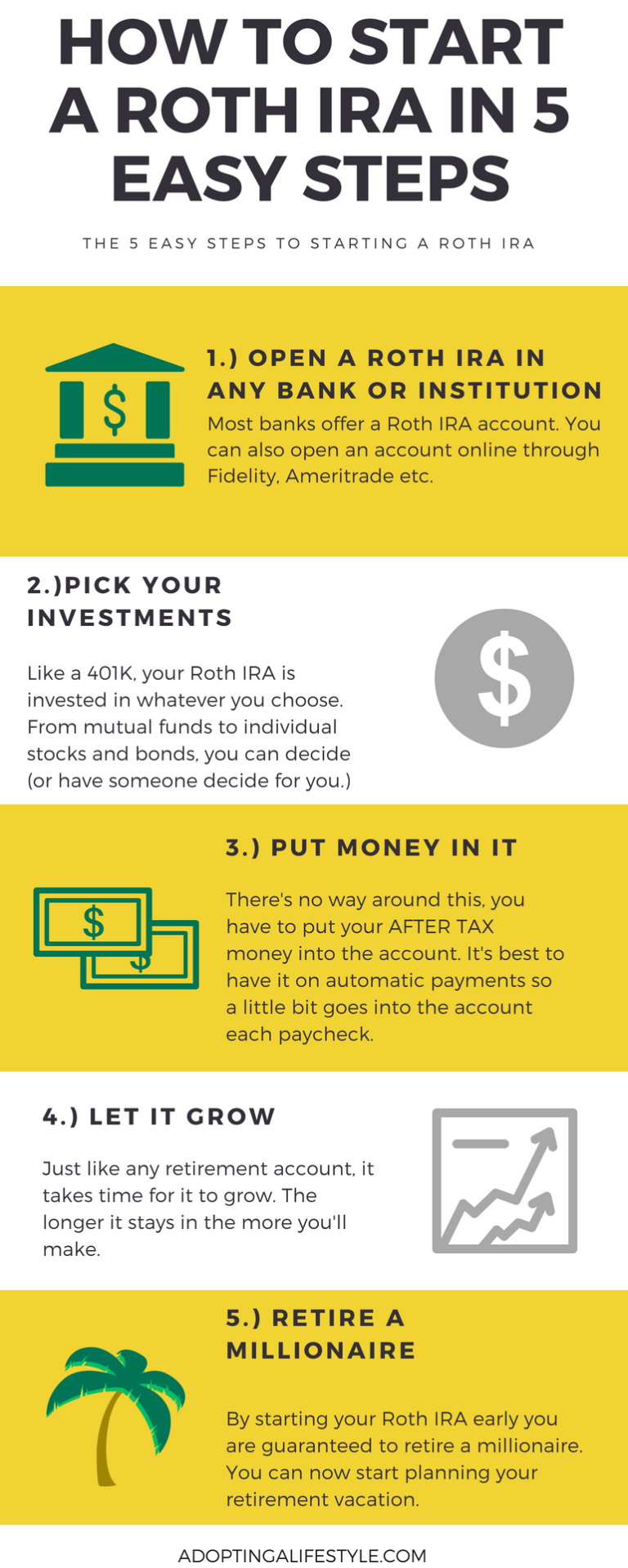

A Roth IRA is a retirement savings account that offers unique tax advantages. In this section, we will delve into the key features of Roth IRAs, including eligibility criteria, contribution limits, and the tax treatment of contributions and withdrawals. Understanding the fundamentals of Roth IRAs is essential for comparing them to Traditional IRAs.

What is a Traditional IRA?

A Traditional IRA is another type of retirement savings account that provides tax advantages. In this segment, we will discuss the main features of Traditional IRAs, including eligibility criteria, contribution limits, and the tax treatment of contributions and withdrawals. This may interest you : Proposal would require businesses with 5 or more workers to offer retirement savings plan. Understanding the basics of Traditional IRAs will help in contrasting them with Roth IRAs.

Tax Treatment of Contributions

This section will focus on the tax treatment of contributions for both Roth IRAs and Traditional IRAs. We will explore how contributions to each account type are taxed, including whether they are made with pre-tax or after-tax dollars. To see also : What Is a Qualified Opportunity Fund?. Understanding the tax implications of contributions is crucial for determining which account type may be more beneficial in your specific situation.

Tax Treatment of Withdrawals

One of the key considerations when comparing Roth IRAs and Traditional IRAs is the tax treatment of withdrawals. This segment will discuss how withdrawals from each account type are taxed, including whether they are subject to income tax or potentially tax-free. On the same subject : Is Roth IRA better for young workers? || Darrin Gifford. We will also explore the rules and requirements for taking distributions from both types of accounts.

Contribution Limits and Eligibility

This section will cover the contribution limits and eligibility criteria for Roth IRAs and Traditional IRAs. We will discuss how much you can contribute to each account type per year, as well as the income limits that may affect your ability to contribute. Understanding the contribution limits and eligibility requirements will help in determining which account type you qualify for and can maximize your contributions.

Making the Right Choice: Factors to Consider

Conclusion

Comparing Roth IRAs and Traditional IRAs is essential for making informed decisions about your retirement savings. Both account types offer unique tax advantages and considerations, including the tax treatment of contributions and withdrawals. By evaluating factors such as current tax situation, future tax expectations, income level, and retirement goals, individuals can make the right choice that aligns with their needs. Seeking guidance from financial advisors or tax professionals can provide additional insights and help in creating a comprehensive retirement savings strategy.