If you don’t have access to the future shares of the future technology giant, it’s pretty hard to turn a modest retirement account into a tax-free piggy bank.

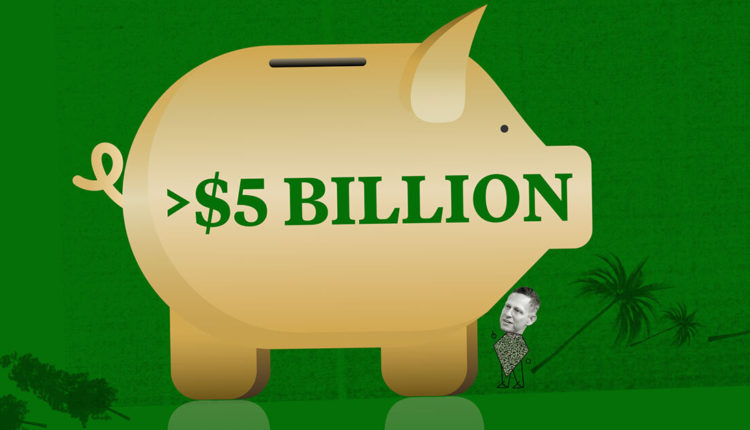

Last week, ProPublica published a story about how PayPal co-founder and technology investor Peter Thiel managed to turn a Roth IRA worth about $ 2,000 into a jaw $ 5 billion in non-taxable old-age pensions in just 20 years.

The story is even more remarkable because Congress created the Roth IRA in 1997 to encourage middle-class Americans to save for their golden years. Most Americans struggled to do even that; the average bill was worth about $ 39,000 in 2018. But Thiel and other billionaires have managed to turn their earthly Rothes into giant land tax havens.

Thiel has managed to launch his Roth into the stratosphere through a complex strategy that involves buying non-public stocks at bargain prices – the kind of business most people can’t access. Experts say it risked violating rules designed to prevent IRAs from becoming illegal tax havens. (Thiel’s spokesman did not answer questions.)

Other ultra-rich Americans have used various means to build Roth worth tens or hundreds of millions of dollars. Senate Finance Chairman Ron Wyden is now considering how end Roth use as “another tax evasion that allows mega millionaires and billionaires to avoid paying taxes.”

How are they able to do that while you can’t? Take a look at our explaining one of the ways Roth works for the ultra-rich, not for you.

Help us report taxes and the ultra-rich

Do you have expertise in tax law, accounting or wealth management? Do you have any sharing tips? Here’s how to get in touch. We are also looking for concrete advice and wider expertise.

Maybe I know something about your investigation.

Send advice via our form

We take privacy seriously. All tips you submit via the form above are encrypted at our end. But if you want additional anonymity, contact via one of these methods:

I am versed in one of these areas and can answer questions or help you understand the technical details.

Volunteer in your expertise

James Bandler and Patricia Callahan contributed to the reporting.