Contents

When can I contribute to a Roth IRA for 2021?

The maximum amount you can deposit into a Roth IRA for 2021 is $ 6,000 if you are under 50. If you are 50 and over, you can add an additional $ 1,000 per year as a “catch-up” premium for a total contribution of $ 7,000. (The limits were the same in 2019 and 2020).

You can continue to contribute to your Roth IRA for the current tax year by the tax return deadline for that year, which is normally April 15 of the following year.

For 2021, 2020, and 2019, the total contributions you make each year to all your traditional IRAs and Roth IRAs must not exceed: $ 6,000 ($ 7,000 if you’re 50 or older) or. If less, then your annual taxable compensation.

You must wait until you are at least 59 1/2 and the Roth IRA is five years old before withdrawing the returns on your investment.

Can I contribute to a Roth IRA for 2021?

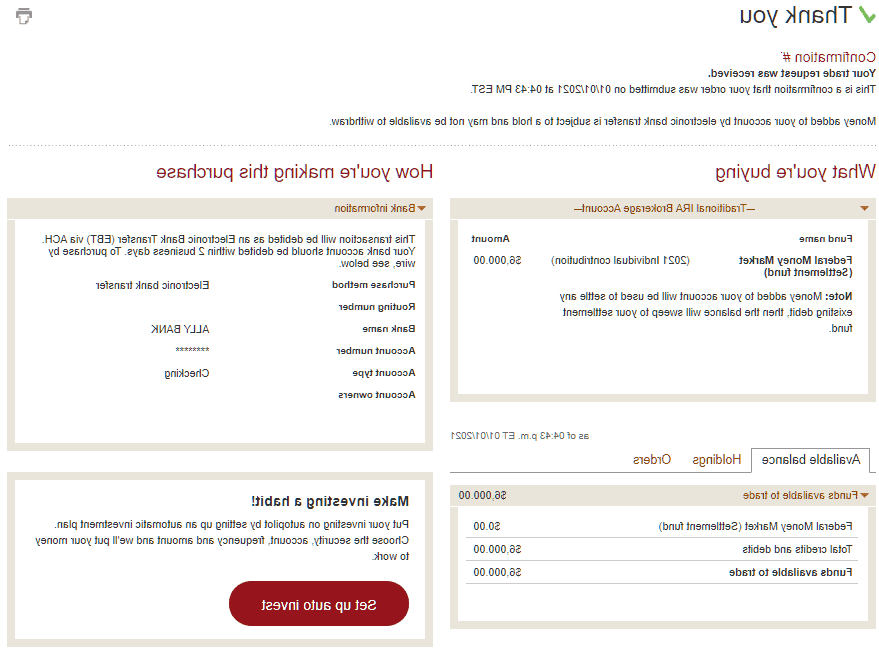

You can pay the IRA contribution for a given year at any time between January 1 and the end of the tax return of the following year (usually April 15). So you can pay your IRA contribution in 2020. Between January 1, 2020 and April 15, 2021 – but we don’t recommend waiting.

The maximum amount you can deposit into a Roth IRA for 2021 is $ 6,000 if you are under 50. If you are 50 and over, you can add an additional $ 1,000 per year as a “catch-up” premium for a total contribution of $ 7,000. (The limits were the same in 2019 and 2020).

You can continue to contribute to your Roth IRA for the current tax year by the tax return deadline for that year, which is normally April 15 of the following year.

For 2021, 2020, and 2019, the total contributions you make each year to all your traditional IRAs and Roth IRAs must not exceed: $ 6,000 ($ 7,000 if you’re 50 or older) or. If less, then your annual taxable compensation.

What is the downside of a Roth IRA?

This is because you pay taxes on your Roth IRA contributions in the year you pay them. So if you don’t earn much, you’ll be in a lower tax bracket and give less of your hard-earned money to the government. But when you make a lot of money, the Roth IRA can hurt you.

Yes, you can lose money with the Roth IRA. The most common reasons for losses are: negative market fluctuations, early withdrawal penalties and insufficient connection time. The good news is that the more time you allow the Roth IRA to grow, the less likely you are to lose money.

Disadvantages of a Roth IRA

- You pay taxes in advance.

- The maximum contribution is low.

- You have to set it up yourself.

- There are income limits.

- Your savings grow tax free.

- There is no need to use the required minimum distributions.

- You can withdraw your contributions.

- You gain tax diversification in retirement.

Key Conclusions. A Roth IRA or 401 (k) makes the most sense if you are confident that your income in retirement is higher than it is today. If you expect your income (and tax rate) to be lower in retirement than it is today, it is better to set up a traditional account.

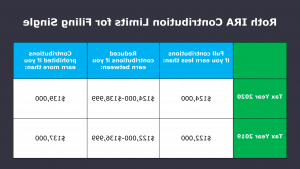

What is the maximum Roth IRA contribution for 2021?

The maximum amount you can deposit into a Roth IRA for 2021 is $ 6,000 if you are under 50.

You can pay the IRA contribution for a given year at any time between January 1 and the end of the tax return of the following year (usually April 15). So you can pay your IRA contribution in 2020. Between January 1, 2020 and April 15, 2021 – but we don’t recommend waiting.

Traditional and Roth IRA deposit limits for 2021 Traditional and Roth IRA deposit limits in 2021 will be the same as in 2020. If you are under 50, you can deposit up to $ 6,000 in 2021. If you are 50 or more, you will get $ 1000 catch up which raises this limit to $ 7000.

For 2021, 2020, and 2019, the total contributions you make each year to all your traditional IRAs and Roth IRAs must not exceed: $ 6,000 ($ 7,000 if you’re 50 or older) or. If less, then your annual taxable compensation.

What is the 5 year rule for Roth IRA?

You can always withdraw Roth IRA contributions without penalty at any age. At 59½, you can pay both premiums and earnings without any penalties as long as your Roth IRA has been open for at least five tax years. 5ï »¿

The 5-Year Roth IRA Principle In general, you can withdraw your earnings without paying taxes or fines if: You are at least 59.5 years old i. It has been at least five years since you first contributed to any Roth IRA (” 5-year rule “)

The Roth IRA is also subject to the five-year inheritance rule. The beneficiary must dispose of the entire value of the inherited IRA by December 31 of the year encompassing the fifth anniversary of the owner’s death. In particular, no RMDs are required over a five-year period.

2. The 5 Year Rule for Converting a Traditional IRA to a Roth IRA. The second 5-year rule only applies to funds that are part of the Roth conversion. … You have to pay income tax on the transferred, or “converted,” amount in the year you convert the Roth.

Can I have multiple ROTH IRAs?

While having more than one Roth IRA is perfectly acceptable, maintaining multiple accounts can have downsides. … Also, it’s important to note that no matter how many Roth IRAs you have open, the total limit you put into them cannot exceed $ 6,000.

If you are contributing more than the IRA or Roth IRA contribution limit, the tax laws charge 6% excise duty for one year on the excess for each year you remain in the IRA. The IRS imposes a 6% tax penalty on the excess amount for each year in the IRA. …

Yes, as long as you meet the eligibility requirements for each type You can keep both a traditional IRA and a Roth IRA as long as your total contribution does not exceed the Internal Revenue Service (IRS) limits for the year and you meet certain other eligibility requirements.

This is because you pay taxes on your Roth IRA contributions in the year you pay them. So if you don’t earn much, you’ll be in a lower tax bracket and give less of your hard-earned money to the government. But when you make a lot of money, the Roth IRA can hurt you.

What if I contribute too much to Roth IRA?

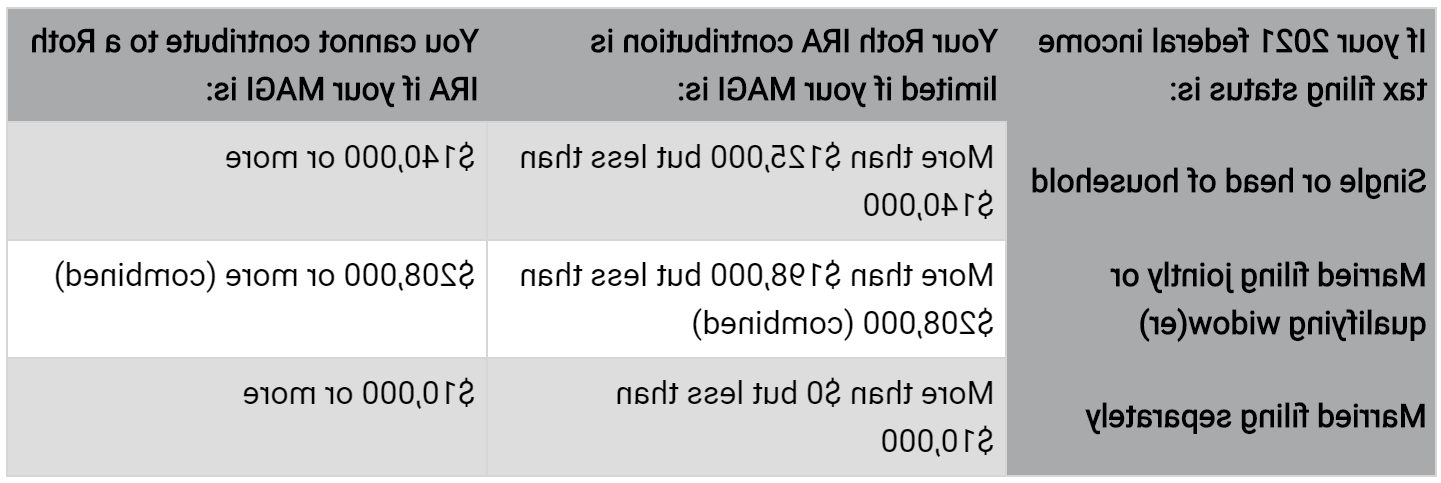

What is the maximum income limit to contribute to a Roth IRA?

At what age must you stop contributing to a Roth IRA?

Key Findings After you retire, you can continue to contribute to the Roth IRA as long as you have some work income. After age 59, you can start taking tax-free payments of both contributions and earnings from the Roth IRA if you have had an account for at least five years.

Thanks to the SECURE Act, you can now make contributions to traditional IRAs beyond the previous age limit of 70 and a half years. There is no age restriction on opening a new, traditional IRA, as long as you fund it through a roll-over or transfer from an eligible retirement account.

There is no age limit for Roth IRA contributions. … Unlike traditional IRAs where deposits over the age of 70 are not allowed, you are never too old to open a Roth IRA. As long as you continue to get your earned income and breath, the IRS is fine with opening up and funding the Roth.

At 72, the employee must begin to collect the required minimum wages from his retirement account. … Employees aged 72 and over may still contribute to IRA, 401 (k) and other retirement accounts, depending on their specific circumstances.

How does the IRS know if you contribute to a Roth IRA?

Roth IRA contributions are not listed anywhere on your tax return, so they are often not tracked, with the exception of monthly Roth IRA statements or the annual tax reporting form 5498, IRA Contribution Information.

Roth IRA contributions are not deductible (and you do not report contributions on your tax return), but qualifying withdrawals or withdrawals that are contributions are not taxable. To be a Roth IRA, the account or annuity must be marked as a Roth IRA when set up.

Form 5498: IRA Contributions Information reports your IRA contributions to the IRS. Your trustee or IRA issuer – not you – must file this form with the IRS by May 31. … The body that manages your IRA must report on a form all contributions that you put into the account during the tax year.

Roth IRA contributions are not taxable because the contributions you make to them are usually made of money after tax and you cannot deduct them. Earnings in your Roth account may be tax-free, not deferred. So you cannot deduct your Roth IRA contributions.

Can a married couple have two ROTH IRAs?

How much can I bring? If you are filing a joint return and are entitled to taxable compensation, both you and your spouse can contribute to your own separate IRA. … It doesn’t matter which spouse earned. Roth IRA and IRA deductions have different income limits.

There is no limit to the number of Individual Retirement Accounts (IRAs) you can have. No matter how many accounts you have, your total contributions for 2020 must not exceed the annual limit of $ 6,000 or $ 7,000 for those 50 years of age and older.

While having more than one Roth IRA is perfectly acceptable, maintaining multiple accounts can have downsides. … Also, it’s important to note that no matter how many Roth IRAs you have open, the total limit you put into them cannot exceed $ 6,000.

The deposit limit for the Roth IRA is $ 6,000 for 2019, up from $ 5,500 in 2018.

Will IRA contribution limits increase in 2021?

Total annual contributions for Traditional and Roth IRAs must not exceed: 2020: $ 6,000, 2021: $ 6,000 (under 50) 2020: $ 7,000, 2021: $ 7,000 (aged 50 or over)

Contribution limits for the retirement plan for 2021 The contribution limit for employees aged 50 or older who participate in these plans also remains constant in 2021 at $ 6,500 (for a total contribution limit of $ 26,000 for employees aged 50 and over).

Here’s how the 401 (k) plan limits will change in 2021: … – The 401 (k) Compensation Limit will increase to $ 290,000. – Income limits for the savings loan will increase to $ 33,000 for individuals and $ 66,000 for couples. Take note of these new 401 (k) rules when making your retirement savings decisions for 2021.

The maximum amount you can put into a traditional IRA for 2021 is $ 6,000 if you are under 50 years old. Employees aged 50 and over may add an additional $ 1,000 per year as “catching up.” contribution, bringing the maximum IRA contribution up to $ 7,000.

How much can I put in my IRA in 2021?

Total annual contributions for Traditional and Roth IRAs must not exceed: 2020: $ 6,000, 2021: $ 6,000 (under 50) 2020: $ 7,000, 2021: $ 7,000 (aged 50 or over)

IRA payment deadlines: 2021 Taxpayers can start paying contributions using the limits for 2021 Starting January 1, 2021 This deadline will expire when taxes become due in 2020. It will be April 15, 2022.

The 401 (k) contribution limits will remain the same in 2021, but some income limits for 401 (k) plans will increase. … – The limit of the 401 (k) equalization contribution is $ 6,500 for persons aged 50 and over. – The Employer and Employee Contribution Limit will be $ 58,000.

As of 2021, the contribution limit for employer sponsored 401 (k) programs remains at $ 19,500 for those under the age of 50 and $ 26,000 for those aged 50 and over. age 50.

What is a backdoor Roth?

The Roth IRA backdoor is a way for high income people to bypass Roth’s income limits. … About these Roth IRA income limits: In 2020, the government only allows people with modified adjusted gross income below $ 206,000 (married jointly) or $ 139,000 (single) to contribute to a Roth IRA .

If your federal income tax bracket is 32% or more, making a Backdoor Roth IRA is a terrible, terrible idea. … It’s nice to have tax-free money to withdraw in your retirement. Being able to diversify your sources of retirement income is always a great thing.

Convert Last Year Before Filing Your Taxes You have until the federal tax filing deadline in each tax year to make your IRA contributions. In most years, this magic date is April 15th. If you haven’t filed your 2019 taxes yet, you have until April 15, 2020 to complete your backdoor conversion to Roth IRA.

Backdoor Roth Conversion basically allows you to convert your non-deductible traditional IRA into a Roth IRA, even if your income is too high to donate to a Roth IRA. … Backdoor Roth Conversion enables high income individuals to build Roth IRA assets.

How much can a 65 year old contribute to an IRA?

Key Conclusions. Under the terms of the 2019 SECURE Act, all retirees can now contribute to traditional IRAs if they are earning an income. Retirees can continue to donate earned funds to the Roth IRA indefinitely.

2019 IRA Deposit Limits The maximum amount you can deposit into a traditional IRA in 2019 is $ 6,000 if you are under 50 years old. Employees aged 50 and over may add an additional $ 1,000 per year as “catch up”. contribution, bringing the maximum IRA contribution up to $ 7,000.

Income. You can open and contribute to the Roth IRA each year in which you earned income, and you can contribute 100% of your income each year, up to the maximum amount permitted by law. … You can make contributions even if you are in Social Security, but you cannot contribute more than your income.

IRA contributions over the age of 70 2019 In 2019, if you are 70 ½ or older, you cannot make regular IRA contributions. However, you can still contribute to a Roth IRA and make a rollover to a Roth or Traditional IRA, regardless of your age.