Contents

By Patrick Kuster, AIF

When it comes to deciding which accounts to own which investments, it is a common misconception that the investments of your highest expected return are always purchased within your Roth IRA. In other words, there is a highly accepted rule to avoid less profitable investments within your Roth and to always aim to maximize income tax-free growth. This may interest you : A smart way to save for retirement in Illinois could get even smarter | Editorial. But this decision should not be one-dimensional, and your asset location strategy should strive to optimally balance the expected return after tax with the expected risk after tax.

Traditional approach

Roth IRAs experience a non-taxable income distribution, and as there are no required minimum distributions (RMDs), your investment can grow until you decide to take the funds (or your beneficiaries are forced to distribute the funds one day). Further complicated by some indirect benefits of the Roth IRA – such as a distribution that does not count on adjusted gross income, which could potentially keep you eligible for certain deductions or avoid increased Medicare costs – we can understand why many quickly conclude that priority is growing within Roth -and the IRA is the most efficient.

But this approach is not always optimal. The waters become murky when a non-retired account is introduced into the combination (like a joint account) because Uncle Sam generally participates in the risk of investing in retirement accounts, but not with Roth IRA investments. As I talked about earlier, owning a $ 1 share in your Roth IRA, where you bear all the risk, is not the same as owning $ 1 of the same share in a joint account. And when we adjust to this difference in risk, we can conclude that it is optimal to give some riskier investments a priority to a non-resident account, rather than Roth IRAs.

Focus on taxes

The level playing field for the expected return on investment is as much as you expect it to be in your pocket at the end of the day, not Uncle Sam’s (i.e., the expected return after tax). Calculating the expected return after tax is a crucial step in determining the optimal asset placement strategy, and depending on your financial situation and individual investments, it could be quite complex.

Taxable (unqualified) accounts

Taxable accounts, such as joint accounts, receive preferential tax rates on long-term capital gains and qualifying dividends, as well as other potential tax benefits on investment assets such as limited partnerships, while interest income receives a higher regular income tax rate. This is the main reason that bonds and tax-inefficient investments are mostly given priority to tax-deferred and retirement accounts (such as traditional IRAs and Roth IRAs).

You do not receive 100% of the expected return for taxable accounts (unless you are in the 0% tax group), so Uncle Sam bears part of the risk.

Traditional IRA

For traditional IRAs, taxes are deferred, so Uncle Sam collects only when funds are shared from the account. From your point of view, your traditional IRA receives and composes 100% of the expected profit before tax on “your” part of the traditional IRA (the part that will not be paid to Uncle Sam). Yes, part of Uncle Sam goes up and down, and yes, it’s on your account, but the only reason you care about his part at all is because you’re both invested the same way. You both support the same team.

It also means that you get 100% of the expected return before tax on your part of the portfolio and take 100% of the risk of your part of the traditional IRA. Uncle Sam also receives 100% of his portion and risks 100% of his portion. Therefore, we do not adjust expected pre-tax returns or tax risks when compiling, because we are only “growing” your portion of the portfolio (traditional IRA balance sheet less built-in tax liability due to Uncle Sam in the future).

Roth IRA

For Roth IRAs, this math is simple; there is no income tax to be taken into account, so the expected refund after tax is the expected refund. You receive 100% of the expected pre-tax returns and bear 100% of the risk on the entire Roth IRA balance sheet.

All together

Deciding which account to own which investment is more of a process than a consolidated statement or basic rule.

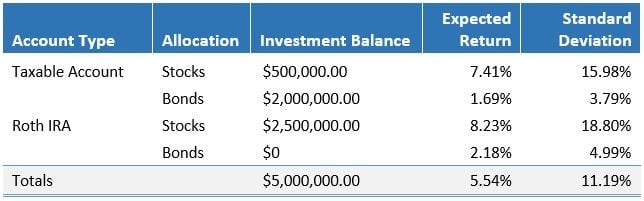

Take the example of John and Jane Doe, who have a portfolio of five million dollars consisting of diversified stocks and bonds. Following the traditional approach, they prioritized their tax-inefficient bonds to IRAs and placed their highest-yielding deposits (their diversified stocks) in their Roth. They are in the income tax class of 24%, long-term capital gains (LTCG) of 15%, and we would like to look at the expected balance of their tax after tax for five years.

For the illustrative purposes of our article, we will assume that shares are taxed at the LTCG rate per year (this assumes one hundred percent turnover basically every 366 days; a rather aggressive assumption for shares), and that all interest and bond income is taxed at normal income rates.

After years of Roth conversions, John and Jane Doe have a $ 2.5 million Roth IRA and a $ 2.5 million joint (taxable) account. With shares prioritized by the Roth IRA, their portfolio is distributed as follows:

The expected value of this tax after tax is $ 6,603,188.80 for five years.

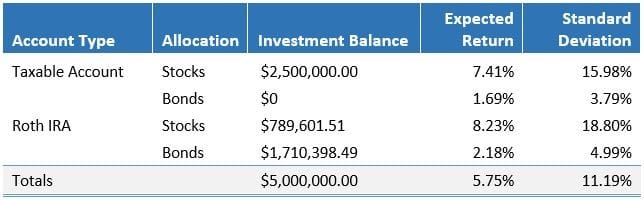

If we first replenished the stocked account with inventory and then settled the amount of inventory in the Roth IRA that would keep the standard deviation after tax at 11.19% (i.e. at the same expected risk after tax):

Our expected value after tax increased by approximately $ 49,100 over five years to $ 6,652,290.78, retaining the same amount of post-tax risk. It’s worth noting in this example that the portfolio increased its share allocation by about $ 290,000, but as Uncle Sam participates in an additional $ 2 million of stock risk (now on a taxable account), John and Jane Doe’s total risk exposure remains the same.

Special considerations

There are some cases where the decision to locate a property requires additional caution and consideration. As an example, if you plan to use all or part of your traditional IRA funds for future Qualified Charitable Distributions (QCDs), it may be best to “carve” the current traditional IRA assets to put into this future QCD, as the charity takes the risk of these funds and basically your tax rate is 0%.

Influence

Traditional approaches to locating assets influence decision-making between traditional and Roth IRAs. Placing tax-inefficient investments in IRAs, whether traditional or Roth, is generally beneficial to most investors. However, when deciding between taxable accounts and the IRA, investments with higher expected returns (and therefore generally higher risk) require more attention. Just because a Roth IRA has real estate with no income tax doesn’t mean you’re always better off taking 100% of the investment risk.

By adjusting the risk for your portfolio, you can use the asset location decision to potentially increase the expected return after tax or reduce the expected risk after tax. In any case, properly implementing an asset location optimization strategy increases the efficiency of your portfolio and increases the likelihood of your financial plan succeeding.

As a wealth advisor with Buckingham strategic wealth, Patrick Kuster, AIF®, knows that even the most thorough and well-conceived financial life plan is as good as its implementation. He works closely with clients to help them solve a financial conundrum – splitting plans, renewing them, and then going through them – and achieving their most important retirement goals.

Important discovery: The opinions of prominent authors are their own and may not accurately reflect the opinions of Buckingham Strategic Wealth®. This article is for general information only and is not intended to serve as specific financial, accounting, or tax advice. The examples given are for illustrative purposes only and do not reflect any specific client experience. Return data is for example only. The investment involves risk, including loss of principal. Individuals should talk to qualified professionals based on their unique circumstances. The analysis contained in this article may be based on third party information and may become obsolete or otherwise be replaced without notice. Third party information is considered reliable, but its accuracy and completeness cannot be guaranteed. IRN-21-1974

Do you have questions about your taxes, personal finances and investments? Get answers!

Email Jeffrey Levine, CPA / PFS, Director of Planning at Buckingham Wealth Partners, to: This may interest you : WILLIAMS: Extra time to fund IRA for 2020 | Community.