Many, if not most people, identify themselves as average middle class people, although in reality – thanks to income, lifestyle, education and happiness – we can actually live better and have more than we think. More than many others who are truly statistically average.

Things like estate planning are meant for people, whether by birth, job, or happiness (or all three), who have a benevolent estate. Most of us are worth more dead than alive. And this is especially true for federal and postal workers, and career military personnel, who earn an annuity with survivor benefits throughout their working life / service, have a generous 401,000 (savings plan) plan and life insurance. Not to mention maybe home. Maybe even a place on the beach or in the countryside.

For many career allies, a will downloaded from the Internet may not do the job. Easy for everyone not to cut. It may not fulfill your wishes and may raise legal, logistical and emotional issues that may last for decades.

Tom O’Rourke, a property tax attorney, recommends that everyone, especially members of the federal family, inspect real estate every three years. Least. For many reasons, including taxes. He will be my guest today Your turn at 10:00 ET streaming here or on the radio at 1500 in the morning in the area of the DC metro. Here’s what O’Rourke, who himself was a former federal Tax Administration official, had to say:

Federal workers probably value the value of a fair tax system, as do any group in the country. Maybe better than most. Maybe because they are also on taxation on giving and receiving. And they actually see how the sausage is produced and know how good (or not) the end product is.

Most adult adults or retirees probably feel that everyone should pay their fair share. Starting with yourself. But don’t overpay. Especially out of ignorance or indifference. It’s an expensive shrug. Why? Because tax rules are constantly changing. And most of us can’t keep up. As a result, you or your property may pay too much to the state or the federal government. Many do not care about the status of their “property”, because they think that they do not have it. But if you’ve been working for a while, especially for Uncle Sam, chances are you might own the property. And have a bank account. And money in TSP. If you check any of these boxes, you have a property. And there is a great chance that you are worth more dead than alive. Sad, perhaps, but true. So, what can you do about it?

Most people who have survived a family death know that preparing and doing the best for their loved ones and friends is more than the will you have taken or the instruction to have your favorite nephew get your car (and all the remaining payments).

My typical answer to how often a property plan needs to be checked and reviewed, and maybe it’s a change when your circumstances change or when the law changes, ”he says. “Only you know if your circumstances will change. Common examples of a change in circumstances that require a change of possession plan are birth, death, marriage, divorce, and a change of relationship with the person mentioned in your plan, or a change in your financial situation. Your advisors (lawyer or financial planner) should inform you of any changes in the law that affect your property plan.

There have been a number of changes in the law in recent years that have made it prudent to review your property plan. With the enactment of the Security Act in 2019, two changes have been made that could affect your strategies. In particular, it has increased the age at which an individual must start withdrawing money from deferred tax accounts from 70 to 72 years. Second, it eliminated the possibility of using IRA stretching. The stretching of the IRA allowed the beneficiary of the deferred tax plan to expand payments from the deferred tax account during his lifetime.

Major changes to the property tax law are also under discussion. A law was introduced to reduce real estate tax exemptions from the current level of 11.7 million to 3.5 million dollars. Although this is still very much expected. The insurance law limited the delay period to ten years for many beneficiaries. You may want to consider the impact of this change on the people you appoint as beneficiaries of any tax-deferred funds you have.

With the big exception, some people who have state pensions, TSP accounts, life insurance and homes may approach or exceed this level. In addition, there have been discussions about limiting or abolishing other property tax breaks. At this point, there were only general discussions and no concrete proposal. It is advisable to keep track of how you can determine what, if any, changes in your property plan.

Some of the strategies you might consider are the following:

- Review your IRA strategy. Is it prudent to turn into a Roth IRA?

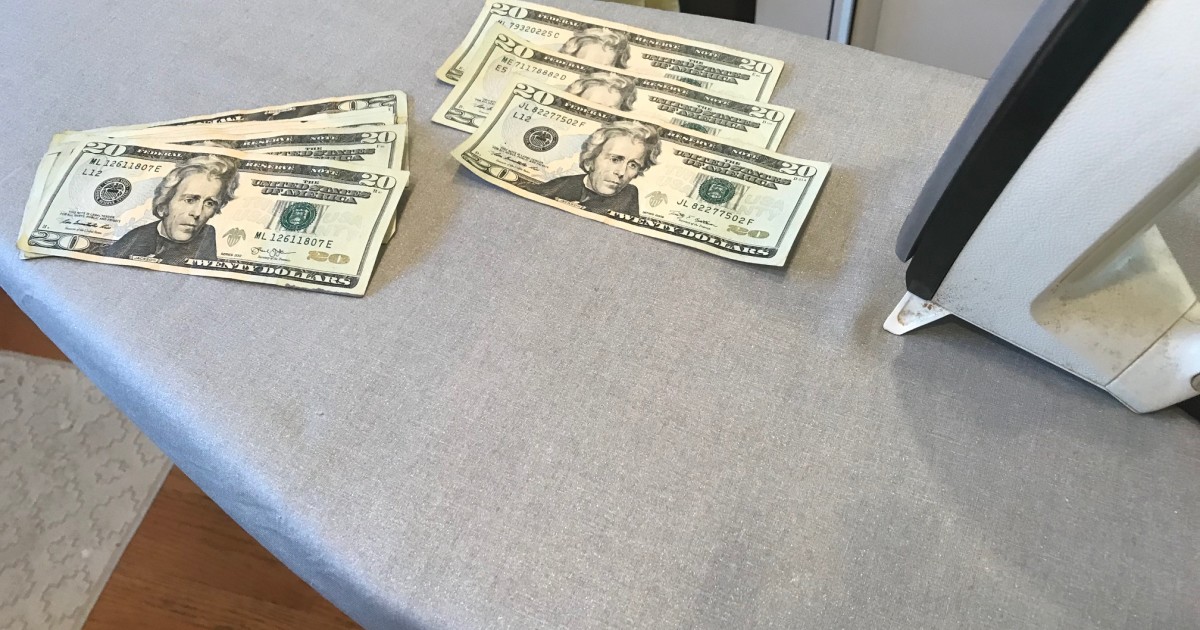

- Take advantage of a $ 15,000 discount per person for taxes.

- Take the opportunity to pay your loved one for education or medical expenses. This not only avoids the gift tax, but also reduces real estate tax exposure.

- Use the plan account from section 529 to help your child or grandchild and avoid tax.

- Consider establishing trust to care for your spouse while reducing tax exposure and controlling the final distribution of your assets.

- Protect your property from the claims of any of the user’s creditors.

At the moment, perhaps the best advice is to pay attention to the property tax changes that Congress can implement and discuss these issues with your advisors. And at least every 36 months. If you do, your property plan can be modified to be tax-efficient in line with your goals.

Listen to today’s show. That could save you and your family a lot of money and trouble!

An almost useless factoid

By Alazar Moges

The word taser is actually an abbreviation. Created in 1974 by NASA researcher Jack Cover, the weapon was actually named after Tom Swift, a character in a series of adventure books about a teenage inventor. This may interest you : Proposal would require businesses with 5 or more workers to offer retirement savings plan. Swift in one of the books creates a rifle to shoot electricity. Cover used this as inspiration and with a little flexibility came up with Tom Swift and his electric rifle, called the Taser.

Source: Business Insider